I have copied an entire Twitter thread for you. Partly because he explains it so well and partly because these embedded stories don’t trigger the email throttling that occurs when I email these links to my regular readers. (Don’t get an email? Sign up in the top right hand corner.) Times are hard and going to get much much harder. Currently every single taxpayer in the US is liable for $245,191 debt. There is no way we’re getting out of this unscathed.

Financial markets across the developed world are breaking.

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

Give me 5-6 minutes and I’ll explain the why and how – but also sadly why there is no good outcome from here, only very bad and worse.

The 2020s are not going to be fun to live through.

A thread 🧵🧵🧵 pic.twitter.com/TXl2v4h6ov

Start with the most fundamental problem. For 50 yrs the west spent > earned, then borrowed money.

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

I’m based in the UK, yet we all live in a dollar based global financial system, so let’s start there with a quick look at the great webpage: https://t.co/uKafWgzWQa

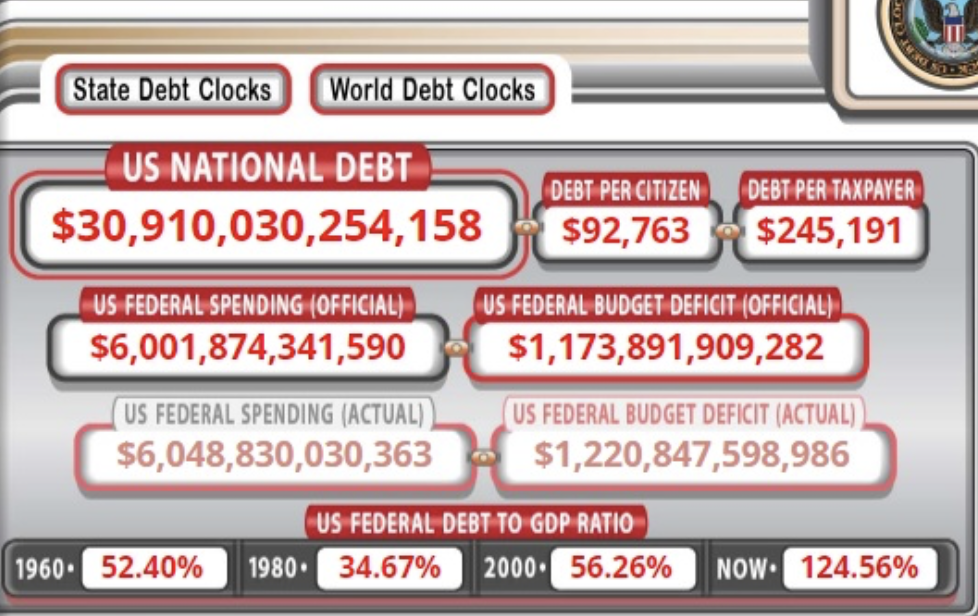

Lets start with the debt the US Gov has accumulated by itself, so ignoring Private debt, State debt or even promises to pay for the future, like pensions or Medicare

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

We are seeing $30tr in debt. Which is $245,191 debt that needs to be repaid for every single taxpayer in the US. pic.twitter.com/jG0O3HQiZJ

Now just that alone should be enough to produce am “oh shit – we got a serious problem!” reaction. But trust me, we are not even beginning to touch the scale of the problem we have here.

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

Next consider US Gov revenues last year, an impressive $4.8tr

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

And as anyone with any understanding of government will tell you, that is not the amount of revenue they feel they need to ask for, that is actually the absolute maximum amount of money that they can get hold of. pic.twitter.com/m9aIjo1Bx1

Yet that stupendous amount of revenue is predicated on certain base assumptions, like the US having abundant cheap energy, and being a global superpower with the ability to do business anywhere, anytime. Who knows if these assumptions will be true ten years from now.

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

Yet it is still short by a massive $1.2 trillion a year.

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

That’s enough money to buy single person who lives in New Hampshire, Montana, North Dakota & Alaska a new Lamborghini every year. pic.twitter.com/GTDJ6PKGdy

But as mentioned above that’s only current Gov debt. Add State & Local ($9878), unfunded liabilities ($515,285 per citizen) – all those promises to pay pension and medical costs to those Baby Boomers whose vote you have been buying with this debt for all these years. pic.twitter.com/mOV22DWuj9

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

And of course personal debt, another $70,991 each.

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

A grand total of $851,223 debt per US citizen or $2.2 million per US taxpayer.

The sum total of all US assets per citizen is only $551,019 per citizen, so even if you sold everything you still can’t get there. pic.twitter.com/2xYRZuYW30

But we can just eat the rich if we really need to right?

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022

Well no, this video is an oldie, but if anything is even more true now than it was then, and explains why eating the rich is not the solution you might think it is: https://t.co/tCs7GzJea6

I’ve picked on the US, but it's no better in any other western nation. Some of us have lower government debt to GDP, but then again we have way higher pension and medical obligations that are not paid for. So every developed nation is in very hot water. https://t.co/0TDadCDCjb

— Dan 🇬🇧 🧢 (@Kingbingo_) September 24, 2022